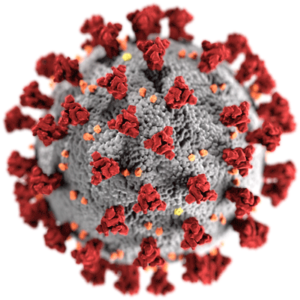

Dan Voelker of the Voelker Litigation Group opened the $100 for 100 Project, which allows lawyers and law firms to give back and express appreciation for the essential workers who are working to keep us fed, safe, healthy and everything else during the COVID-19 pandemic.

Dan Voelker of the Voelker Litigation Group opened the $100 for 100 Project, which allows lawyers and law firms to give back and express appreciation for the essential workers who are working to keep us fed, safe, healthy and everything else during the COVID-19 pandemic.

The $100 for one hundred concept is for lawyers and law firms throughout the United States to give back to the essential workers who have so selflessly and tirelessly provided them with essential services during the COVID-19 pandemic.

Each donor lawyer or law firm will hand-out 100 $100 dollar bills to those who have helped in their neighborhood or community. With each $100 bill will be a business card with a message of thanks and appreciation – and a link to the $100 for 100 website where recipients can post a comment of thanks in return.

Are you an attorney or law firm who would like to say thank you to essential workers?

View Attorneys and Law Firms who have signed up to provide $100 to each of 100 essential workers

View lawyers and law firms here…

View thank you notes from Recipients

View thank you notes from recipients here…

Tags appreciation for essential workers, covid-19, essential workers, pandemic, thank you, thank you notes

One significant concern to businesses is the risk of inadvertent disclosure of their trade secrets and proprietary information in the wake of the pandemic. When they say that we are currently operating in uncharted waters, this is no understatement. What were once heavily-guarded trade secrets and proprietary information are now spread across the kitchen table and being communicated via unsafe internet connections. This risk of hacking and actual disclosure of the same is significant.

One significant concern to businesses is the risk of inadvertent disclosure of their trade secrets and proprietary information in the wake of the pandemic. When they say that we are currently operating in uncharted waters, this is no understatement. What were once heavily-guarded trade secrets and proprietary information are now spread across the kitchen table and being communicated via unsafe internet connections. This risk of hacking and actual disclosure of the same is significant.