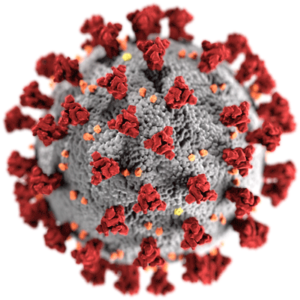

The SARS CoV-2 coronavirus causes COVID-19 disease.

In the current environment, employers are biting their nails in fear of liability claims from their employees who contract COVID-19 in the workplace. Is this a risk? While no appellate court, much less a trial court, has yet to decide this issue, the answer is most likely negative.

Follow CDC and OSHA Guidelines

This, of course, presumes that, as employer, you maintain proper social distancing within the employee ranks, require protective masks and clothing, as the case may be, and follow generally accepted guidelines issued by the CDC and OSHA.

Company Policy on Illness

This outcome is also contingent upon, among other things, close scrutiny of the health of your workforce and an open policy that permits employees to bow out of the work place at the first symptom of an illness without fear of reprisal or demotion.

Deviating from Protocols Could Result in Devastating Liability

On the other hand, employers who allow non-essential workers to go back to work prematurely or to break social distancing guidelines, will surely face suits from sick employees and their families. Given the harsh realities of the virus and its relatively high mortality rate, deviating from the protocols set out by the regulatory authorities and social norms could result in devastating liability to the employer. As some intentional conduct is not covered by insurance, the risk of a break-the-company verdict is a real concern as well.

In sum, employers whom exercise good judgment and put the health of their workforce ahead of profits will have little risk of liability. Those that do not, face an almost certain risk of suit and a potentially large damage award.

Have questions about employee liability claims?

Call Dan Voelker at (312) 870-5430.

Tags CDC protocol, coronavirus, covid-19, employer liability, OSHA guidelines, pandemic, shutdown, worker illness